Saving money doesn’t have to be a monotonous task. In Singapore, a variety of options allow you to watch your savings grow more efficiently. Understanding how to leverage high-yield savings accounts can make a significant difference in achieving your financial goals.

Why High-Yield Savings Accounts?

Traditional savings accounts often offer minimal interest rates, barely keeping up with inflation. High-yield savings accounts, on the other hand, provide considerably better returns on your deposits. This means your money works harder for you, quietly compounding over time.

Features to Look For

When scouting for the perfect savings account, consider factors like interest rates, accessibility, and fees. Some accounts might offer enticing rates but come with withdrawal restrictions or maintenance fees that could offset your gains. Striking the right balance is key to maximizing your returns.

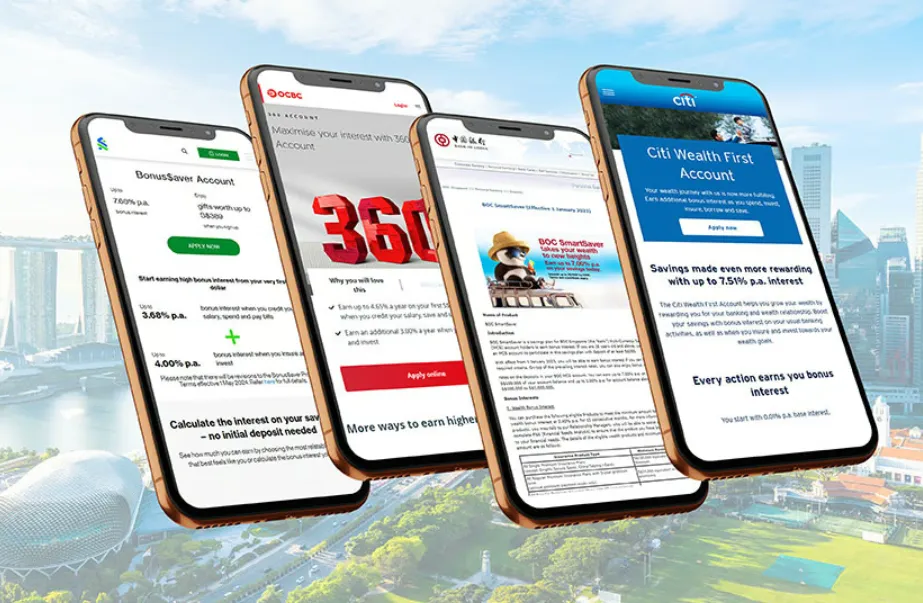

Top Picks in Singapore

Singapore’s financial landscape is rich with options. Banks like DBS, OCBC, and UOB often feature competitive rates alongside convenient digital banking services. Exploring these options ensures you find an account that aligns with your financial habits and goals.

Maximizing Your Earnings

Consistency is crucial. Regularly adding to your savings and avoiding unnecessary withdrawals can significantly boost your account’s growth. Additionally, keeping an eye on promotional rates can provide temporary boosts to your earnings.

Understanding the Terms

It’s easy to get caught up in the allure of high interest rates, but comprehending the terms and conditions is equally important. Some accounts may require a minimum balance or have tiered interest rates based on your deposit amount. Being informed helps you avoid surprises down the line.

Embracing Digital Tools

Modern banking offers a plethora of digital tools to help manage your savings effectively. Mobile apps and online platforms provide easy access to your account, enabling you to monitor your growth and make adjustments as needed.

Finding the Right Fit

Every individual’s financial situation is unique. Evaluating your savings goals, risk tolerance, and financial behavior will guide you towards the best high yield savings account for your needs. There’s no one-size-fits-all solution, so take the time to assess your options carefully.

Real-Life Success Stories

Consider the case of a friend who switched to a high yield savings account and saw a noticeable increase in their savings within a year. Small changes can lead to substantial results, proving that with the right approach, your money can grow more effectively.

Additional Resources

For those ready to take the next step, exploring various high yield savings account options can provide further insights into maximizing your savings potential.

Conclusion

Maximizing your returns through high-yield savings accounts in Singapore is entirely achievable with the right knowledge and strategies. By choosing the right account, staying consistent, and leveraging available tools, your savings can grow more robustly than ever before.